Swing Trading vs Day Trading in Crypto

Depending on time availability, risk tolerance, and profit objectives, cryptocurrency traders usually decide between swing and day trading. Knowing the distinctions between these two strategies enables traders to choose the best course of action for sustained success.

What Is Swing Trading?

Swing trading involves holding positions for several days or weeks to profit from medium-term price movements.

Advantages

- Less time-consuming

- Lower stress

- Fewer trading fees

- Better for part-time traders

Disadvantages

- Slower profits

- Exposure to overnight market risk

What Is Day Trading?

Day trading involves buying and selling crypto within the same day, sometimes multiple times.

Advantages

- Fast profit potential

- No overnight risk

- Frequent opportunities

Disadvantages

- High stress

- Requires constant attention

- Higher transaction fees

- Emotionally demanding

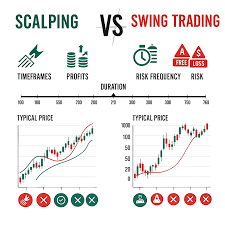

Key Differences: Swing Trading vs Day Trading

| Feature | Swing Trading | Day Trading |

|---|---|---|

| Trade Duration | Days–Weeks | Minutes–Hours |

| Time Required | Low | High |

| Risk Level | Moderate | High |

| Stress Level | Low | High |

| Suitable For | Beginners & part-timers | Experienced traders |

Which Is Better for Beginners?

Swing trading is usually better for beginners because it:

- Requires less screen time

- Reduces emotional trading

- Allows more thoughtful decisions

Common Mistakes to Avoid

- Overtrading

- Ignoring risk management

- Using high leverage

- Emotional decision-making

Conclusion

Day trading and swing trading can both be profitable, but which approach is best for you will depend on your risk tolerance, experience, and way of life. Swing trading is a good place for beginners to start before moving on to day trading.