Fundamental vs. Technical Analysis in Crypto Trading

Fundamental and technical analysis are two core approaches used in crypto trading to evaluate tokens and predict price movement...

The Influence of Market Sentiment on Token Prices

Market sentiment plays a powerful role in shaping token prices, often driving price movements beyond fundamentals. Understandin...

Evaluating Cryptocurrency Projects Before Investing

Not all cryptocurrency projects are created equal. Conducting thorough due diligence helps investors identify strong fundamenta...

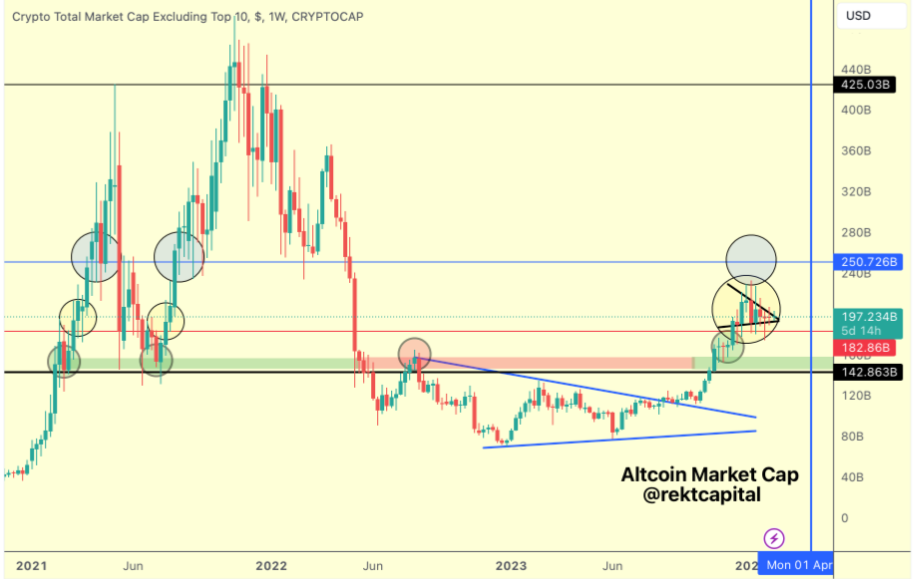

Volatility Dynamics Within Cryptocurrency Markets

Cryptocurrency markets are characterized by extreme volatility. Understanding the dynamics behind rapid price fluctuations help...

Most Popular

Yield Farming and Liquidity Mining: Opportunities and Risks

Yield farming and liquidity mining have become popular ways to earn passive income in decentralized finance. While these strategies offer attractive returns, they also involve significant risks that investors must understand before committing capital.

Understanding DEX Aggregators and Liquidity Providers

DEX aggregators and liquidity providers are essential components of decentralized finance. They improve liquidity, optimize trade execution, and enable efficient token swaps across multiple decentralized exchanges without relying on centralized intermediaries.

How Whales Influence Cryptocurrency Market Movements

Cryptocurrency whales—individuals or entities holding large amounts of digital assets—play a significant role in shaping market movements. Their trading activity can impact prices, liquidity, and market sentiment, making it essential for investors to understand how whales operate.

Fundamental vs. Technical Analysis in Crypto Trading

Fundamental and technical analysis are two core approaches used in crypto trading to evaluate tokens and predict price movements. Knowing how each method works—and when to use them—can help traders make informed, data-driven decisions in volatile cryptocurrency markets.