How to Read Crypto Charts for Beginners

Crypto charts display how cryptocurrency prices have changed over time. One of the most crucial trading and investing skills for novices is the ability to read these charts.

This guide explains the basics of crypto chart analysis in simple terms.

Types of Crypto Charts

1. Line Chart

Shows the closing price over time. Best for a quick market overview.

2. Bar Chart

Displays opening, closing, high, and low prices.

3. Candlestick Chart

The most popular type, showing detailed price movement.

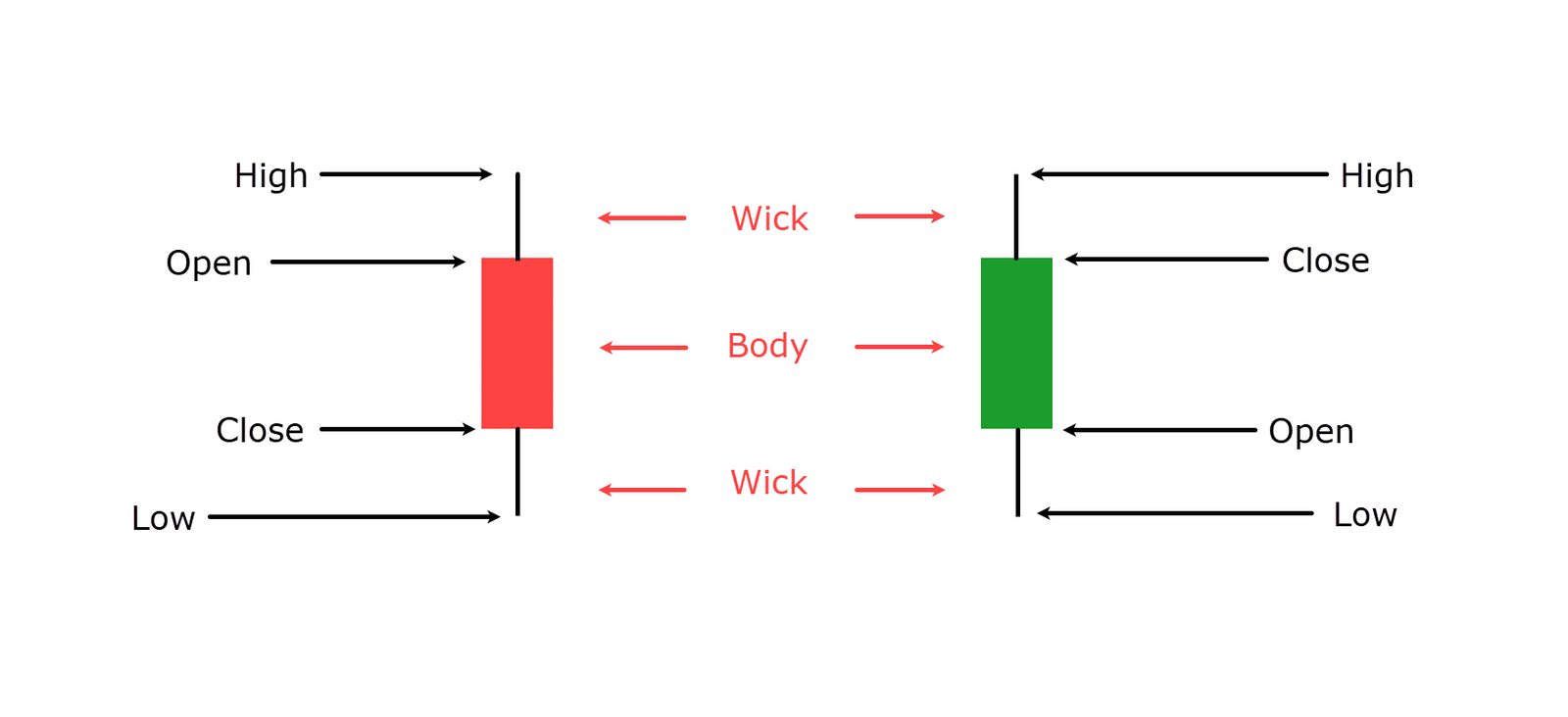

Understanding Candlesticks

Each candlestick shows:

Each candlestick shows:

- Open price

- Close price

- High price

- Low price

Green candle = price increased

Red candle = price decreased

Time Frames

Charts can be viewed in:

- 1 minute

- 5 minutes

- 1 hour

- 1 day

- 1 week

Short time frames = short-term trading

Long time frames = long-term investing

Key Chart Concepts

Support & Resistance

- Support: price level where buying interest is strong

- Resistance: price level where selling pressure appears

Trends

- Uptrend: higher highs and higher lows

- Downtrend: lower highs and lower lows

- Sideways: stable price range

Popular Indicators for Beginners

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Volume

These indicators help predict future price movement.

Simple Trading Strategy

- Identify the trend

- Mark support & resistance

- Confirm with RSI & volume

- Enter trade

- Set stop-loss & take-profit

Common Beginner Mistakes

- Overtrading

- Ignoring trends

- Trading without a plan

- Emotional decisions

Conclusion

Gaining proficiency with cryptocurrency charts lowers risk and boosts confidence. Beginners can become proficient traders and make wise choices with discipline and practice.