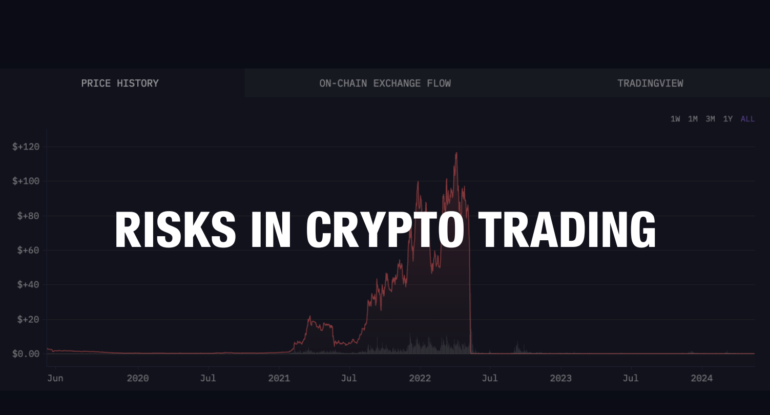

How to Manage Risk in Crypto Trading

Although there is a lot of potential for profit, trading cryptocurrency carries a significant risk. Many novices fail due to inadequate risk management rather than poor tactics.

This guide explains the most important principles of managing risk in crypto trading.

Why Risk Management Matters

Without risk management:

-

Small losses turn into large losses

-

Emotions control decisions

-

Capital disappears quickly

With risk management:

-

You survive market volatility

-

Protect your trading capital

-

Trade with confidence

1. Never Risk More Than You Can Afford to Lose

Only invest money you can afford to lose without affecting your life. This reduces emotional pressure and poor decisions.

2. Use Stop-Loss Orders

Stop-loss orders automatically close your trade at a preset loss level.

They protect your account from unexpected price crashes.

3. Follow the 1–2% Rule

Risk only 1–2% of your total trading capital per trade.

This ensures you can survive a series of losing trades.

4. Avoid Overtrading

More trades do not mean more profit.

Quality trades > quantity of trades.

5. Diversify Your Portfolio

Avoid putting all funds in one coin.

Spread investments across multiple assets.

6. Control Emotions

Fear and greed destroy trading accounts.

Always follow your trading plan.

7. Use Proper Position Sizing

Never go all-in on a single trade.

Calculate your position size based on your risk tolerance.

8. Keep a Trading Journal

Record every trade:

-

Entry and exit

-

Reason for trade

-

Result

This helps improve discipline and performance.

Common Beginner Mistakes

-

Using high leverage

-

Chasing losses

-

Ignoring stop-loss

-

Emotional trading

Conclusion

Managing risk is more important than finding the perfect trading strategy. By following these principles, beginners can survive market volatility and build long-term trading success.