Top NFT Projects to Watch in 2026

Here’s a curated list of both established “blue-chip” NFT projects and newer or rising NFT ventures with strong communities, utility or growth potential.

🔹 Blue-Chip & Well-Established Collections

Bored Ape Yacht Club (BAYC)

-

BAYC remains widely regarded as a top “blue-chip” NFT collection globally. TopCoin9+2NFT News Today+2

-

Owning a Bored Ape often grants access to exclusive community events, metaverse/social utilities, and long-term brand value — making it more than just digital art. TopCoin9+2Crypto Tiding+2

-

For 2026, veteran investors often see BAYC as a relatively “safer” NFT asset: established liquidity, strong holder community, and historical prominence.

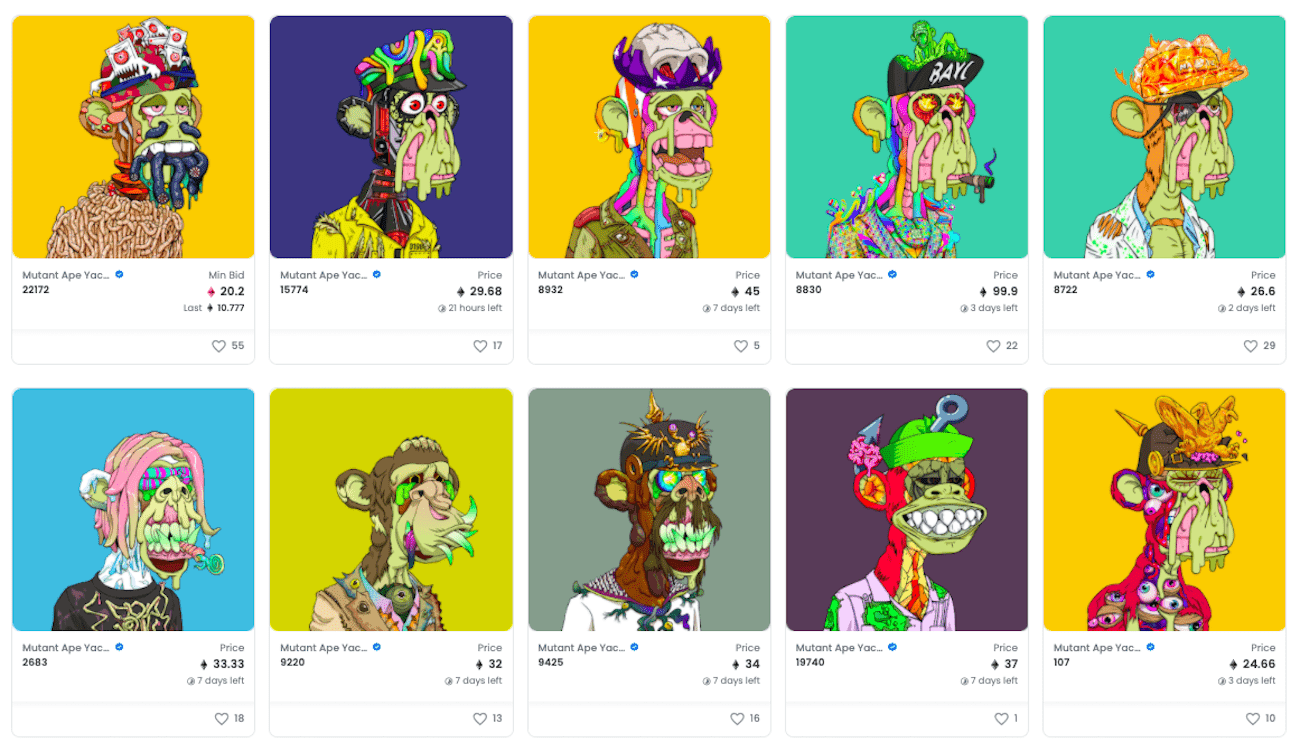

CryptoPunks

-

As one of the original NFT collections, CryptoPunks carries historical and cultural significance — which many collectors value. TopCoin9+1

-

Its legacy, scarcity, and consistent demand make CryptoPunks a perennial favorite among long-term NFT collectors. Bingx Exchange+1

🔹 High-Potential & “Next Gen” Projects

Moonbirds

-

Moonbirds is known for its distinctive art style (cartoon-style owls), a strong community and active engagement — features that help sustain long-term interest. CoinWeb+1

-

The project has shown resilience and adaptability, making it a potential “next-gen blue-chip” for 2026. CoinWeb+1

Pudgy Penguins

-

Pudgy Penguins stands out for its whimsical art, meme-culture appeal, and growing community vibe. Bingx Exchange+1

-

For collectors seeking NFTs with lighter art styles and community-driven identity (vs. high-end exclusivity), this project offers a more accessible entry point. Bingx Exchange+1

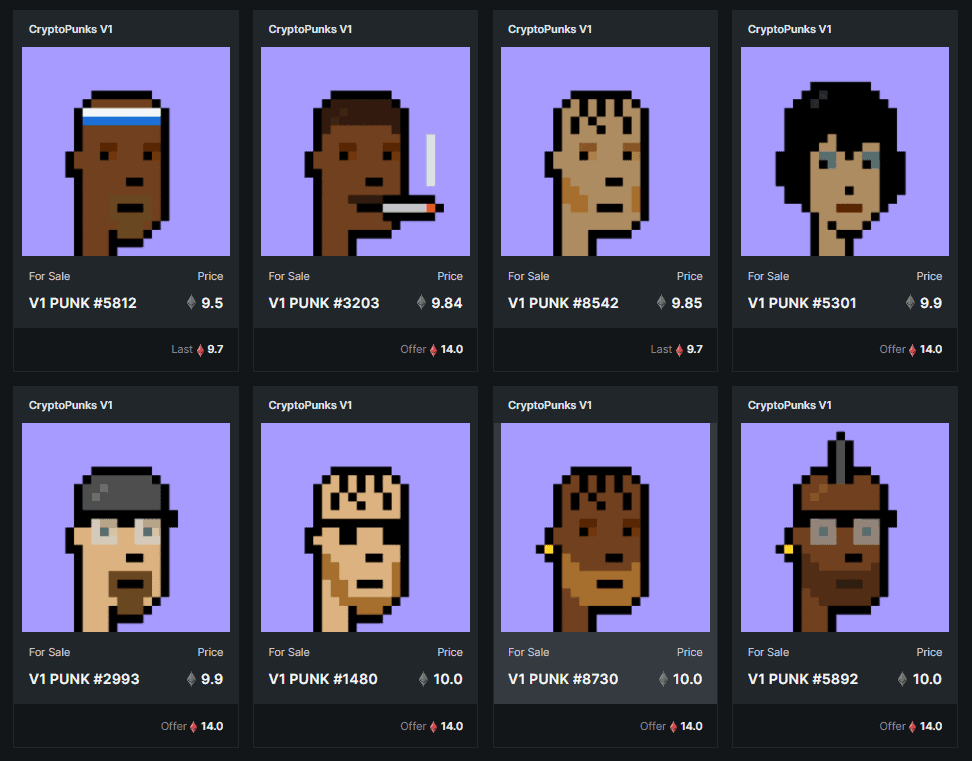

Azuki

-

Azuki’s anime-inspired art and growing community — especially among younger and Gen-Z audiences — give it strong appeal in gaming, fashion, and metaverse-related use cases. NFT News Today+1

-

For 2026, projects like Azuki could benefit from bridging digital art with lifestyle, collectibles, and possibly utility via upcoming Web3 applications. TopCoin9+1

🔹 Promising & Niche Projects — Great for Early Adopters

Metropoly (Real-Estate / Fractional Ownership NFT)

-

Metropoly aims to tokenize real-world properties or real estate — allowing fractional ownership and passive income potential via NFTs. web3.gate.com+1

-

For investors looking for NFTs with “real world utility” (not just art or collectibles), projects like Metropoly could stand out in 2026 — especially as blockchain adoption grows. web3.gate.com+1

Honeyland (Game-Based NFT Project)

-

Honeyland is designed as a game-based NFT ecosystem, where players manage virtual bee swarms, harvest resources, and potentially engage in P2E (play-to-earn) dynamics. web3.gate.com+1

-

As NFT-gaming hybrids gain traction in 2025 and beyond, projects like Honeyland may attract both gamers and investors — especially those interested in utility beyond static art. web3.gate.com+1

⚠️ What to Keep in Mind (Risks & Strategy)

-

Volatility & speculation: NFT values — especially outside blue-chip collections — can swing dramatically. What’s hot today may lose momentum without community support or ongoing utility.

-

Due diligence: Always research the project’s team, roadmap, community activity, and real utility (art, metaverse integration, gaming, real-world assets).

-

Long-term vs short-term: Blue-chip NFTs might offer relative stability; newer/niche projects may have higher upside — but also higher risk.

-

Liquidity & exit-strategy: Some niche NFT projects may lack strong secondary markets. Consider liquidity and resale ease before investing heavily.

🧭 Final Thoughts: How to Navigate NFTs in 2026

-

If you prefer stability and heritage, blue-chip collections like BAYC or CryptoPunks remain relatively “safe bets.”

-

If you’re open to growth potential with more risk, newer projects like Moonbirds, Azuki, Pudgy Penguins, Metropoly, or Honeyland may offer upside — especially if they deliver ongoing utility or community engagement.

-

Always treat NFTs partly as speculative assets, partly as digital community passes or culture artifacts. Value often depends on community, utility, and broader Web3 adoption.

-

Diversifying — mixing blue-chips, promising newcomers, and utility-oriented NFTs — can help spread risk while capturing growth opportunities.