Dollar Cost Averaging Explained

Crypto markets are unpredictable. Prices rise and fall rapidly, making it difficult for investors to time the perfect entry. Dollar Cost Averaging (DCA) solves this problem by removing emotion from investing and replacing it with discipline and consistency.

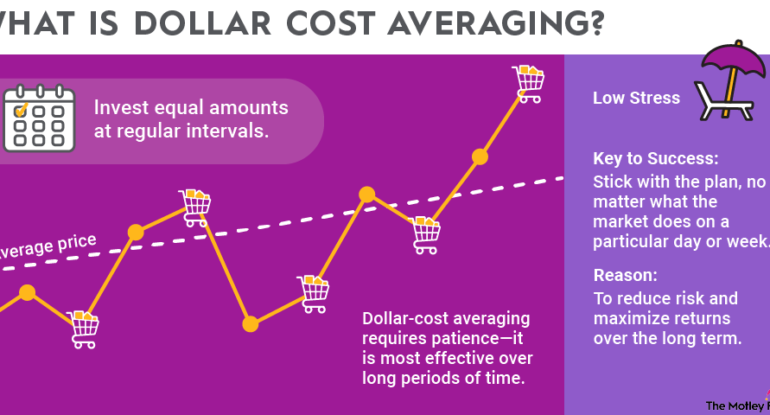

What Is Dollar Cost Averaging?

Dollar Price Investing a set amount of money at regular intervals, regardless of market price, is known as averaging. This lowers the average cost of your investment over time and lessens the impact of volatility.

How DCA Works in Crypto

Example:

You invest $100 in Bitcoin every month.

- When prices are high, you buy fewer coins

- When prices are low, you buy more coins

Over time, your average purchase price stabilizes.

Benefits of Dollar Cost Averaging

- Reduces emotional decision-making

- Protects against market timing mistakes

- Builds long-term wealth steadily

- Works well in volatile markets

- Easy for beginners

Risks and Limitations of DCA

- Lower potential returns in strong bull markets

- Requires patience and discipline

- Not ideal for short-term traders

Best Assets for DCA

- Bitcoin (BTC)

- Ethereum (ETH)

- Established Layer 1 and Layer 2 projects

How to Start a DCA Plan

- Choose your investment amount

- Select your time interval (weekly/monthly)

- Pick quality cryptocurrencies

- Automate your purchases

- Stick to your strategy long-term.

DCA vs Lump Sum Investing

| Factor | DCA | Lump Sum |

|---|---|---|

| Risk | Lower | Higher |

| Emotional stress | Low | High |

| Volatility exposure | Reduced | High |

| Beginner-friendly | Yes | No |

Conclusion

Dollar cost averaging transforms cryptocurrency investing from a risky endeavor into a systematic way to build wealth. By being consistent and disciplined, investors can reduce risk and fully profit from the long-term growth of cryptocurrencies.